In the landscape of investment opportunities, YieldMax and Defiance Funds have emerged as compelling options for investors seeking enhanced returns and diversified portfolios. These funds offer unique strategies and structures designed to optimize yields while managing risk. Let’s delve into the fundamentals of YieldMax and Defiance Funds to understand their workings and potential benefits.

Table of Contents

Understanding YieldMax Funds

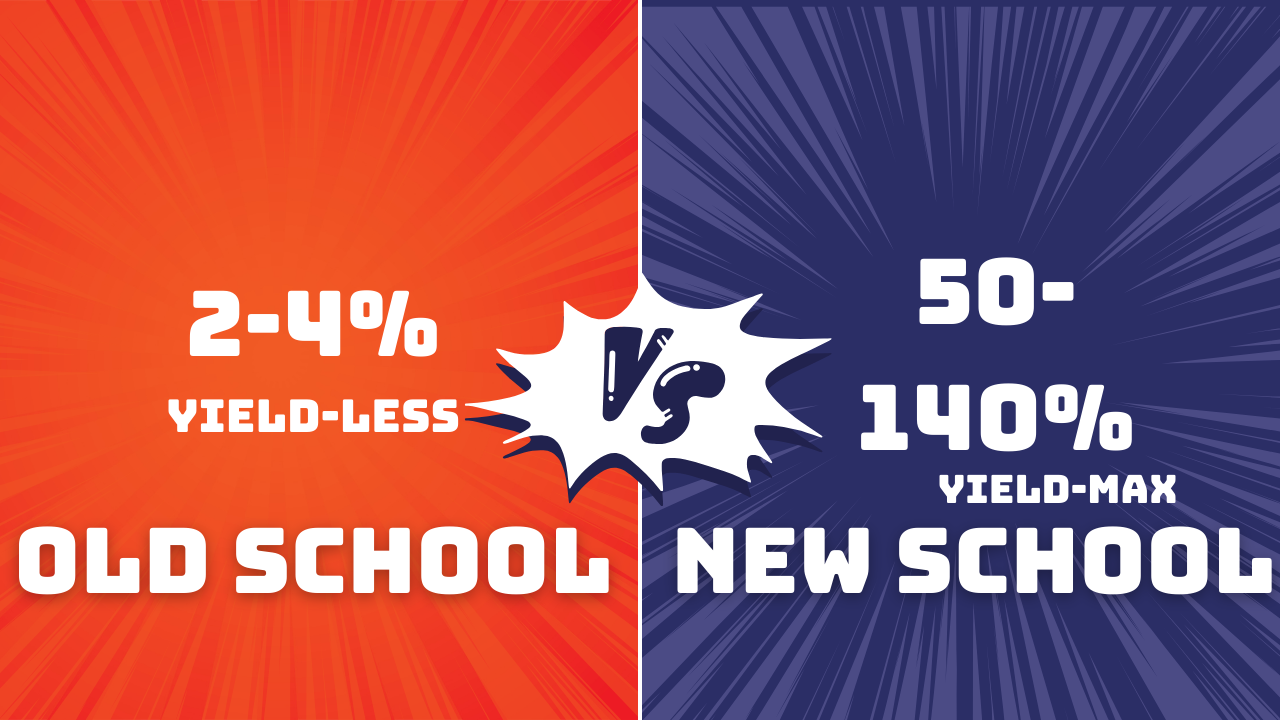

YieldMax Funds are investment vehicles tailored to generate high income streams for investors. They achieve this by employing various strategies, such as:

- Covered Call Strategies: YieldMax Funds often utilize covered call strategies, selling call options on assets within their portfolios to generate additional income.

- Dividend Focus: These funds prioritize investments in dividend-paying stocks, seeking companies with a consistent track record of distributing dividends.

- Risk Management: While aiming for higher yields, YieldMax Funds emphasize risk management, typically by diversifying across asset classes or sectors.

Exploring Defiance Funds

Defiance Funds, on the other hand, are known for their innovative approach to thematic investing. These funds focus on specific themes or disruptive technologies, aiming to capture growth opportunities in evolving sectors. Key features of Defiance Funds include:

- Thematic Focus: These funds concentrate on themes like technology, healthcare innovation, clean energy, or other disruptive sectors poised for growth.

- Actively Managed Portfolios: Defiance Funds are often actively managed, allowing for nimble adjustments to capitalize on emerging trends and market shifts.

- Risk-Reward Balance: While targeting high-growth themes, Defiance Funds aim to balance risk by diversifying across companies within the chosen thematic focus.

Benefits of YieldMax and Defiance Funds

- Income Generation: YieldMax Funds offer attractive income streams through dividends and options strategies.

- Diversification: Both YieldMax and Defiance Funds provide diversification benefits across asset classes or thematic areas, reducing specific risk exposures.

- Potential for Growth: Defiance Funds focus on disruptive sectors, potentially offering above-average growth opportunities for investors.

Considerations for Investors

Before investing in YieldMax or Defiance Funds, consider these factors:

- Risk Tolerance: Assess your risk tolerance as YieldMax Funds may involve options trading, while Defiance Funds might be exposed to volatility within specific sectors.

- Investment Goals: Align your investment goals with the fund’s objectives. YieldMax for income generation, Defiance for thematic growth exposure.

- Expense Ratios and Fees: Evaluate the costs associated with these funds to ensure they align with your investment strategy.

Conclusion

YieldMax and Defiance Funds represent distinct approaches to investing, catering to different investor objectives. YieldMax focuses on income generation through strategies like covered calls and dividends, while Defiance Funds target growth potential within specific thematic areas. Understanding their strategies, risks, and potential rewards is crucial for investors seeking to diversify their portfolios and optimize returns in today’s dynamic market.